Target margin formula

Your net profit margin. Typically 10-20 is a good average to high gross margin to target but the ideal gross margin a business should target varies by industry.

Pin On 20 Unit Rental Property Template

They apply the CVP analysis formula.

. Walmart prefers the lowest cost while Target angles more toward profit margin and youthful image. CoinDCX automatically gives you the additional margin and charges interest 005 per day 0002 per hour. N N 1Ne2 Where.

A low net income means that your company may be struggling with several factors such as poor resource management or inefficient pricing models. Further the contribution margin formula provides results that help you in taking short-term decisions. You are free to use this image on your website templates.

If one wants to know the dollar level of sales to achieve a target net income. No more having to memorize a formula. Given the contribution margin a manager can easily compute breakeven and target income sales and make better decisions about whether to add or subtract a product line about how to price a product or service and about how to structure sales.

Determining the breakeven point and the target income. In other words it is a point at which neither a profit nor a loss is made and the total cost and total revenue of the. This formula is derived by evaluating the companys situation to achieve the break-even point Break-even Point In accounting the break even point is the point or activity level at which the volume of sales or revenue exactly equals total expenses.

In the above example the total profit margin Profit Margin Profit Margin is a metric that the management financial analysts investors use to measure the profitability of a business. Note that is undefined for that is is undefined as is. Target profit fixed costs contribution margin per unit projected sales 140000 14000 19 8105 Bountiful Blankets needs to sell 8105 blankets during the third quarter in order to meet their target profit goal of 140000.

EBITDA is an acronym for earnings before interest taxes depreciation and amortization EBITDA is a helpful formula for companies with long-term growth potential looking for investors and. The contribution margin is 40 which means 40 of the total net sales revenue generated during the year is available to cover all fixed expenses as well as generate profit for the business. Thus the level of production along with the contribution margin are essential factors in developing your business.

Contribution margin 150000 60000 30000 150000 90000 60000. Additional margin is the amount a trader has borrowed from the exchange to fulfill a particular order. This calculator has Cost-Sell-Margin keys that make it very easy to figure out.

Forecasting estimated units of goods to be sold to breakeven or. Contribution margin ratio 60000150000 04 40. Target return is calculated as the.

When the position is open for more than 1 Hour the interest expense is calculated based on the following formula. The formula to calculate gross margin is. Again it is possible to jump to step b by dividing the fixed costs and target income by the per unit contribution margin.

On the other hand a high net income indicates that your company is performing well. Target Cost Formula Projected Selling Price Desired Profit. For a confidence level there is a corresponding confidence interval about the mean that is the interval within which values of should fall with probability Precise values of are given by the quantile function of the normal distribution which the 68-95-997 rule approximates.

Slovins formula is written as. N the number of samples Nthe total population How a sample size calculator works. Industries like grocery retail assisted living and mining routinely have low-profit margins which.

This KPI measures the percentage of profit a company produces from its total revenue. The JF-100MS features CostSellMargin calculations and an Extra Large 10-Digit Display. What is the Break Even Analysis Formula.

Units to Achieve a Target Income Total Fixed Costs Target Income Contribution Margin Per Unit 1500 Units 1800000 1200. A target return is a pricing model that prices a business based on what an investor would want to make from any capital invested in the company. A Break-Even point is a point where the total cost of a product or service is equal to total revenueIt calculates the margin of safety by comparing the value of revenue with covered fixed and variable costs associated with sales.

Key Takeaways Walmart and Target are both low-cost retail stores with gigantic revenues. The kickstand raises the calculator on angle for easy viewing. Break Even Analysis Formula Table of Contents Formula.

Get Target Corp TGTNYSE real-time stock quotes news price and financial information from CNBC. Gross margin Total revenue - COGSTotal revenue x 100. This formula is used when you dont have enough information about a populations behavior or the distribution of a behavior to otherwise know the appropriate sample size.

In Cost-Volume-Profit Analysis where it simplifies calculation of net income and especially break-even analysis.

Financial Ratios Financing Constraints Sample Dissertations Financial Ratio Financial Statement Analysis Accounting

Obviously Awesome A Product Positioning Exercise Startup Marketing Database Marketing Business Intelligence

Profitability Framework Company Financials Online Presentation Business Problems

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Rachel Price This Website Goes Over Target Pricing And Why It Is Used I Like This Because It Breaks Down The Different Reasons As T Target System New Product

Breaking A Business Model Into Customer Value Proposition Cvp Profit Formula Key Resources And K Business Model Canvas Consulting Business Business Process

Supply Chain And Logistics Kpi Dashboard Dynamic Reporting Etsy Kpi Dashboard Supply Chain Supply Chain Logistics

Pre And Post Money Valuation Calculator Plan Projections Budget Forecasting Financial Analysis Financial Modeling

Target Costing Meaning Process Benefits And More Accounting Jobs Bookkeeping Business Accounting And Finance

Pin On Business Plan Entrepreneurship

Pin By Lynsi Ingram On Safebooks Accounting Basics Learn Accounting Accounting Notes

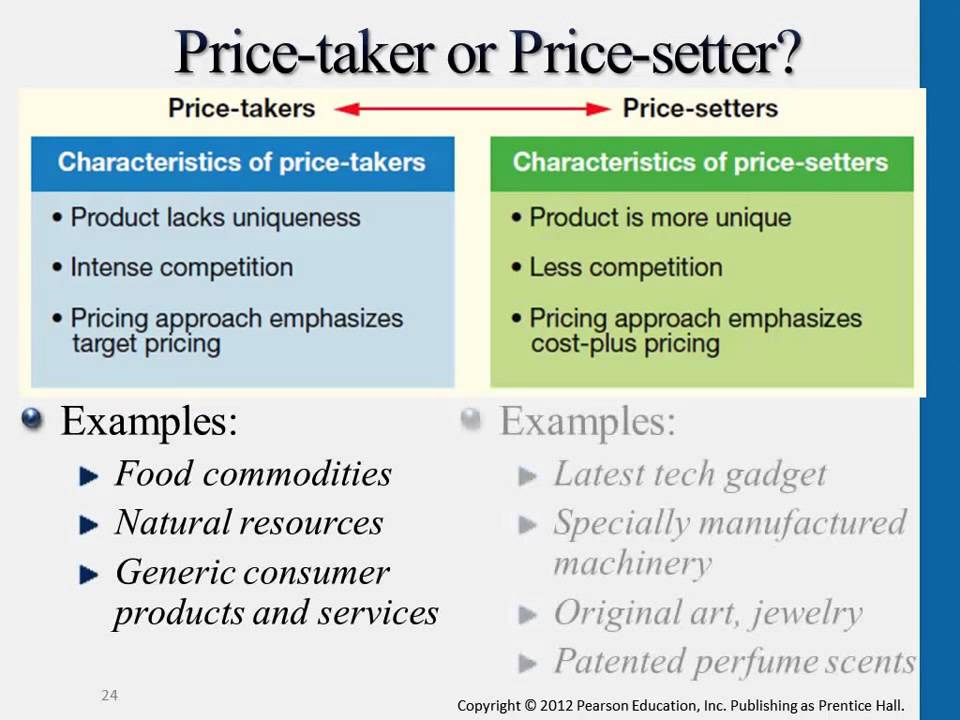

This Video Gave A Good Example Of Price Takers And Price Setters I Found The Examples Given Make It More Relatable Latest Tech Gadgets Relatable Tech Gadgets

This Pin Talks About Du Pont Analysis How It Is Calculated And Its Analysis Finance Investing Fundamental Analysis Financial Quotes

Cost Benefit Analysis Template Excel Check More At Https Nationalgriefawarenessday Com 27365 Cost Benefit A Excel Templates Excel Templates Business Analysis

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

Profit Or Loss Startup Business Plan Gross Margin Start Up Business

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit